Probate Finder OnDemand® offers ease of use in the complex activity of probated estate searching and claim filing. We proudly offer our clients a one-click approach to simplifying this process, allowing internal collection teams to focus on core business functions.

But what lies beyond the claim presentation? Join us as we conclude our three-part series that takes you behind the scenes of Probate Finder OnDemand and addresses common expectations versus reality.

Expectation

“Once the claim is sent, there is nothing more I need to do.”

Reality

While it is true that simply sending a claim will prompt many solvent estates to resolve the bill, our partners with proactive follow up strategies have seen a sizable increase in the number of claims resolved. A simple strategy can consist of three steps:

- Making a follow-up call to the estate representative to confirm your claim was received,

- Inquiring about the status of the estate, and

- Establishing when you can expect resolution of the account.

Using the information gathered you can then determine if any further follow up is needed.

Expectation

“The probated estate is insolvent, so we will not receive any reimbursement to our claim.”

Reality

“Insolvency” means the estate’s debts exceed the value of the estate’s assets. A common misconception among those pursuing estate claims is that insolvency means they will receive no payment. In reality, an insolvent estate could pay out at up to 99% of the claim amount via a pro-rata distribution.

A pro-rata distribution is a percentage of money that the estate can pay to each creditor when the estate is insolvent. Once the estate determines that there are not enough funds after liquidation of all assets, the estate representative may file a petition with the court declaring the insolvency of the estate, or otherwise create an accounting of the estate assets and debts. Such a petition or accounting will demonstrate what is available for payment of creditors.

Expectation

“All claims presented to the probated estate are treated equally.”

Reality

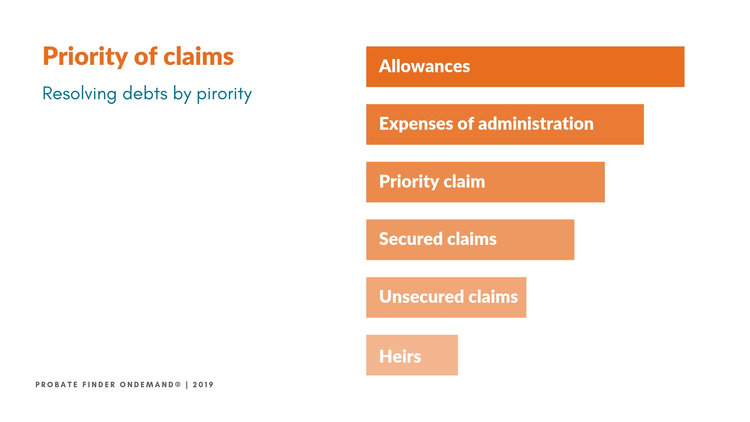

Claims are generally resolved in an order of priority. The order of priority varies by state; generally, taxes and any other government debt are paid first, followed by expenses associated with the burial and administration of the estate, and expenses of final illness. Unsecured creditors are just ahead of distribution to heir and beneficiaries, in the order of priority. Pro-rata distributions often occur among the unsecured creditors claims. Those creditors with unsecured claims share the funds available after higher priority debts are paid. For example, if there is $5,000 left and the unsecured claims total $20,000, then each creditor would receive 25 cents for each dollar that they were owed.

“Claims are generally resolved in an order of priority. This can vary from state to state, but generally, taxes and any other government debt is paid first.”

A final accounting is a complete list of the estate’s assets and debts. If creditors are informed that an estate is insolvent, it is a great idea to ask for a final accounting. It should include a list of all assets with values, as well a list of any and all debt owed by the estate. Creditors can use this information to determine if they are likely to receive payment on their claim and how much that payment should be.

To determine what is available for your organization’s claim, add the value of the assets and then subtract the total amount of debts with higher priority. This determines the amount available for claims of your same level of priority. This number is then divided by the total of all claims at your level of priority to determine what percentage each claim can be paid at.

With knowledge regarding the probate process, support from an experienced staff of probate experts, and the ease of locating and presenting claims that Probate Finder OnDemand provides, our partners are finding revenue in places where they didn’t expect it to exist.

To see Probate Finder OnDemand in action, request a demo today.